Insurers are constantly challenged with compliance requirements changes, most of which heavily rely on excellent data management. It is crucial for insurers to examine their current data management practices with a critical eye and assess if they are setup to strategically answer and adapt to the regulatory changes of the industry. For every compliance requirement changes, the question for most insurers is whether they simply need to create a minimum viable product or seize this opportunity to truly transform their business and take a market leadership position in the insurance industry.

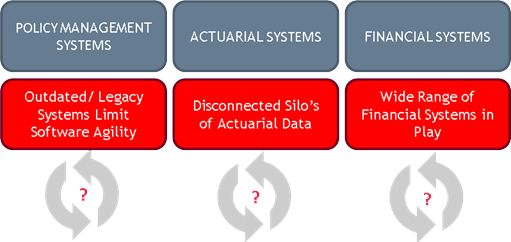

In working with many IT leaders, we recognize that the adoption of the new standard poses many issues for insurers, including:

- Significant data connectivity asks are being made to fulfill compliance requirements.

- Quick decisions on cloud may be required as many accounting engines are only available in a cloud model.

- A complex mix of current and legacy infrastructure present challenges for IT teams.

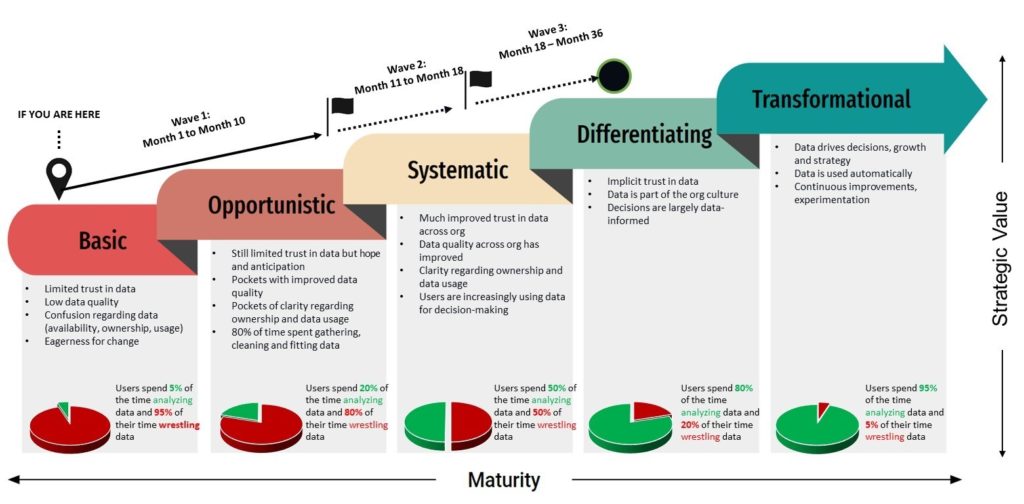

- Considerable differences between insurers in terms of where they are on the data maturity spectrum.

Mature insurers get ahead by putting in place a modern data platform, offering benefits such as:

Data as an asset

The value of the data for most insurers is high given the significant footprint of policy, claims, financial, investments, and reinsurance data residing in a variety of source systems. Establishing the right single source of the truth and manage data as a valuable asset will future proof your business.

Agile data integration

Changes in compliance requirements often require a significant investment in data integration because of the broad impact across the technology and data landscape. Those who take a modern approach to data management are able to achieve economies of scale by leveraging the same integration strategy and platform for current and future compliance requirements.

Moving away from a legacy point-to-point approach and adopt a modern data fabric approach powered by data virtualization sets the foundation for data maturity advancement and advanced analytics outcomes by leveraging the potential of AI.

Data governance and literacy maturity

Pragmatic data governance and modern data operations strategy can be applied as the golden standard to all high-value data sets across the organization. The chart below details the stages of maturity and the strategic value created during each stage.

Insurers who seek to comply with the new standard need to evaluate various data fabric options (logical vs. physical) to determine which one will improve the quality of their data at lower costs and will make the data fabric future ready. Choosing an appropriate fabric, such as a logical data fabric hand in hand with data mesh strategy, powered by data virtualization, may be less costly than upgrading to a point-to-point environment. Over time, insurers should seek to integrate advanced analytics into their new infrastructure to capitalize their overall data maturity and governance.

How BDO can help

BDO, Optimus, and Valani Global have come together to establish accelerators for your modern data platform journey. Our accelerators not only meet several compliance needs , but also advances insurers forward in the areas of financial transformation, operations modernization, and data innovation.

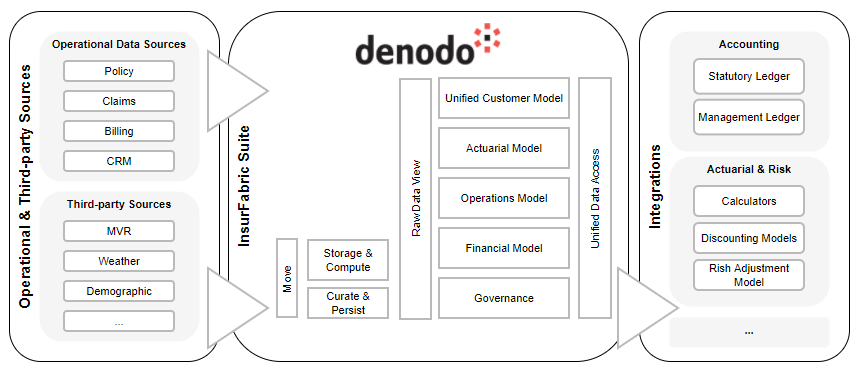

Our data innovation accelerator, InsurFabric is based on the Denodo and Microsoft platforms. It accelerates the path to several compliance requirements and advances an insurer data maturity for advanced analytics. The InsurFabric accelerator shortens the timeline of your modern data platform implementation with data connectivity and workflow processing aligned with the industry. It contains fundamental best practices to be the gold standard for pragmatic data governance and operations.

Join BDO on June 2, 2022 at 12:00pm to learn the keys to a successful data program that embraces the full potential of your data and AI.