In today’s rapidly evolving financial landscape, banks and financial institutions are undergoing massive digital transformations. They’re striving to maintain competitive advantages against both traditional rivals and new digital-first challengers. However, many organizations face a significant hurdle: the presence of legacy technology creating separate data silos that are time-consuming and expensive to integrate using traditional methods. You can see how Denodo Platform on AWS addresses these challenges, offering a streamlined solution for financial services data management.

Top Challenges in Financial Services Today

- Regulatory reporting: Financial institutions often struggle to integrate disparate sources, including external ones, to obtain a single view of risk data. The primary difficulty in this struggle is the time it takes to create such reports, multiplied across the areas of risk that are pertinent to the organizations, such as market, credit, counter-party, or operational risk. Similarly, financial services are often called upon to satisfy compliance with solvency regulations.

- Compliance: Ensuring operations within regulations is crucial for preserving integrity and avoiding costly fines. Financial institutions must engage in a wide range of activities, including protecting against data theft, tax evasion, and money laundering, and promoting ethical conduct and standard processes.

- GenAI readiness for better productivity and hyper-personalization: With GenAI adoption surging, there’s an increasing need for faster, more insightful data. From AI-enabled chatbots to suspicious activity detection, financial institutions must prepare their data infrastructure for these advanced applications, thus freeing up staff for higher level of business planning and judgement.

- Fraud Detection and AML – Organizations need to be able to distinguish normal activity from fraudulent activity, based on a detailed history of customer behavior, claims made and payment pattern. This requires the right data to be able to identify fraud patterns in real time.

- Know Your Customer (KYC) has become a significant element in the fight against financial crime and money laundering, and it also plays an important role in new customer adoption for retail banks. Customer identification is the first step in this process. The first experience customers have with their financial services provider is critical, so ensuring a smooth yet rigorous process is key for all parties.

Introducing Denodo Platform on AWS: A unique solution addressing Financial Services challenges

Denodo Platform leverages data virtualization to address these challenges. But what exactly is data virtualization, and how does it help?

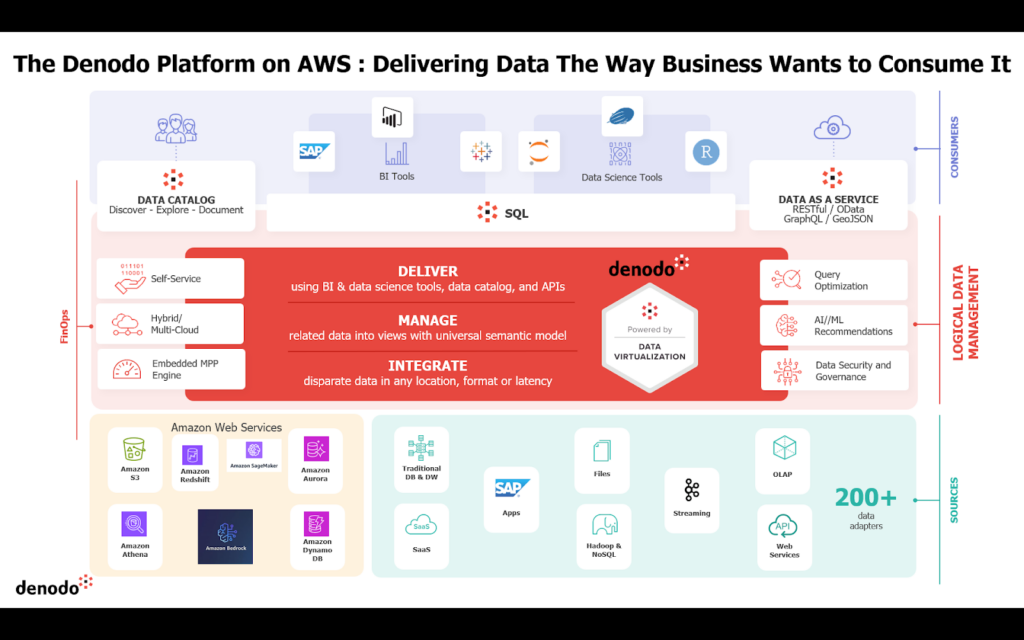

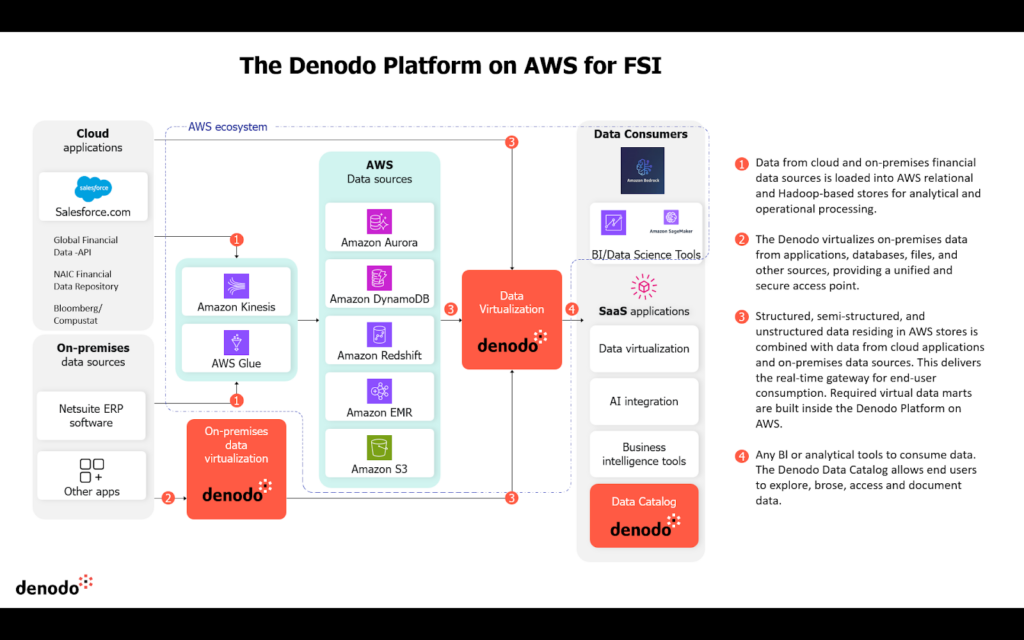

Data virtualization is the core technology that enables logical data management capabilities. Data virtualization establishes a single data-access layer for finding and using all enterprise data, comprised of logical/virtual representations of physical data sources like data warehouses, data lakes, transactional and analytical databases, cloud and enterprise applications’ data services and APIs, and data files. With this centralized, logical layer, data virtualization enables real-time governed access to data stored across multiple heterogeneous data sources.

Logical data management, powered by data virtualization, reduces data integration and delivery costs while boosting management efficiency and agility.

Data virtualization’s ability to work seamlessly with existing infrastructure makes it significantly easier to implement than alternative solutions. The platform delivers real-time data integration across diverse systems – from transactional processing to cloud-based storage – traditionally known for their complex and time-consuming integration processes. This capability enables a broad spectrum of use cases, particularly in regulatory compliance. For instance, it excellently handles requirements around personal identifiable information (PII) management, addressing key GDPR mandates without physically moving sensitive data.

Whether you are an enterprise architect, head of data & analytics, relationship manager in retail banking, or a claims manager in Insurance, there are some pressing questions that you may be looking for answers to. Here are some example questions:

- How do you deliver an omnichannel customer experience when different business units own different parts of the customer lifecycle?

- How can I monitor the portfolio risk in real-time?

- Can I have a 360-degree view of your entities and their relationships with you and each other? Go beyond just using the CRM data. Get all your customer data in focus, in a simpler and quicker fashion?

Denodo Platform on AWS helps banks, insurance companies and other financial services organizations to offer more value to their customers, reduce risk and reduce cost, by enabling them to reach into the many sources of data they already have, and rapidly extract previously untapped business value from it in the form of data products that are directly consumable by the business.

Denodo Platform on AWS and GenAI for Financial Services

Generative AI in banking and financial services offers numerous applications, including automating tasks, enhancing customer service, detecting fraud, providing personalized financial advice, and improving overall efficiency and security.

Denodo’s logical data management capabilities, combined with retrieval augmented generation (RAG) techniques, enable organizations to enhance the accuracy of their GenAI large language models (LLMs) by providing context-rich, real-time data from across hybrid, multi-cloud environments. This leads to more precise responses, reduced AI hallucinations, better decision-making, and the simplified operation of GenAI initiatives.

The Denodo Platform serves as a single, consolidated gateway for AI applications to access integrated data while offering several other key benefits, via a unified, secure access point for large language models (LLM)s to interact with and query all enterprise data with built-in query optimization features that relieve LLMs from managing specific data source constraints or optimized join strategies.

Denodo Platform supports the business processes with a variety of benefits as described below including facilitating various business personas

- Financial and Insurance organizations need unified data easily integrated and accessible => Denodo works with all major sources of AWS data in any format and location to help drive this from data engineering and business users.

- Scalable and flexible data management allows data architects to support burst workload and Denodo Platform on AWS can easily support that functionality using the data fabric and MPP architecture

- Advanced real time insights and data analytics – Addressing the needs of Data Scientists and CDOs, who can now make the best use of data across siloes for delivering data for intelligent behavior tracking and accuracy.

Customer Examples and Use Cases

- Leading U.S. Bank Used the Denodo Platform to Power Open Banking

A major U.S. commercial bank faced fintech competition due to fragmented data across legacy systems, hindering innovation and customer service.

The bank implemented an Open Banking initiative, integrating external data through APIs and using AI to provide real-time insights and personalized services.

Key Innovations using Denodo Platform on AWS

- AI-Powered Personal Finance Assistant: Delivered personalized budgeting and investment advice through

- aggregated financial data.

- Tailored Loans and Credit Products: Offered instant pre-approved credit with a 50% reduction in approval times.

- Business Banking Dashboard: Provided real-time cash flow and account insights for commercial clients.

- Open API Platform: Enabled third-party developers to create custom financial tools using the organization’s data.

Implementing personalized insights and seamless data integration boosted customer engagement by 30% and made loan approvals 50% faster, enhancing customer satisfaction and conversions. New revenue streams emerged from fintech API partnerships, and customer retention increased by 15% due to improved services and faster processing.

- European bank leveraged the Denodo Platform on AWS to enable Hyper-Personalization

One of the largest government owned banks in Europe, with total assets of over 160 billion, has always strived to meet changing customer requirements. Data has become increasingly important in meeting customer needs and providing better customer experience. However, the bank found that its enterprise data did not provide enough context to be fully useful, and it did not provide holistic views to the customers.

The Denodo Platform delivered the necessary data views directly to a dashboard, and the bank leveraged these views to optimize the marketing budget, the success of marketing campaigns, and customer experience. The bank can now derive insights from these views to further develop customer centric product and service features.

If you’re navigating the future of finance and looking to harness the power of Generative AI, don’t miss our latest webinar, Unlocking GenAI Insights in Financial Services. Packed with real-world case studies and expert strategies, this session explores how Denodo and AWS are helping financial institutions accelerate innovation, streamline compliance, and deliver hyper-personalized experiences. Whether you’re focused on open banking, regulatory alignment, or unlocking data across silos, this webinar offers practical insights tailored for today’s AI-driven banking leaders. Watch the webinar on demand to catch up on everything you might have missed.

Getting Started with Denodo Platform on AWS

The Denodo Platform helps you quickly unify and deliver the data your business depends on. With data virtualization, Denodo breaks down silos, making it easy to create AI-ready data products and democratize data for all, making data management and data delivery in financial services a lot more productive and cost effective.

Agora on AWS offers all the robust capabilities of the Denodo Platform and simplifies data management through a fully managed, cloud-based solution. Agora enables organizations to offload infrastructure management and Denodo Platform operations. With Agora, IT and operational teams can focus on business goals, fully leveraging data while minimizing operational overhead, and sustaining agility in a fast-changing business landscape.

You can get started with the 30 days free trial of Denodo Agora via the AWS Marketplace!

- Financial Services Data Management Made Easy with GenAI and Denodo Platform on AWS - April 24, 2025

- Agora, the Denodo Cloud Service – Is Now Available on the AWS Marketplace - December 4, 2024

- Unleash the Power of Generative AI and Denodo Platform to Deliver a Differentiated 10-K Performance with Clinical Trial Data - July 31, 2024